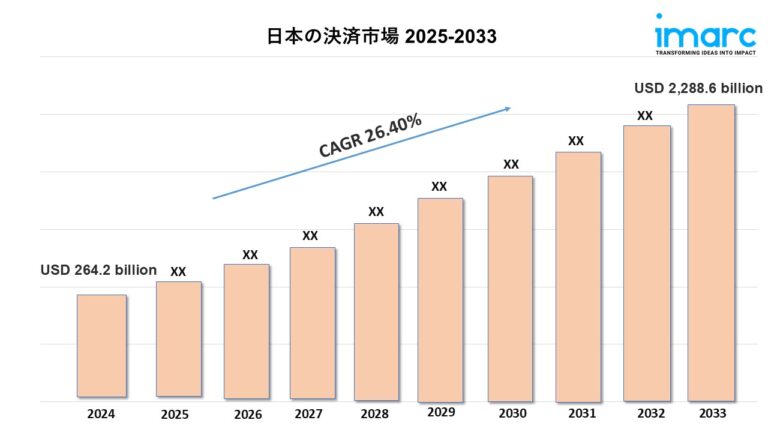

Buy Now Pay Later Market – Japan

Market Statistics

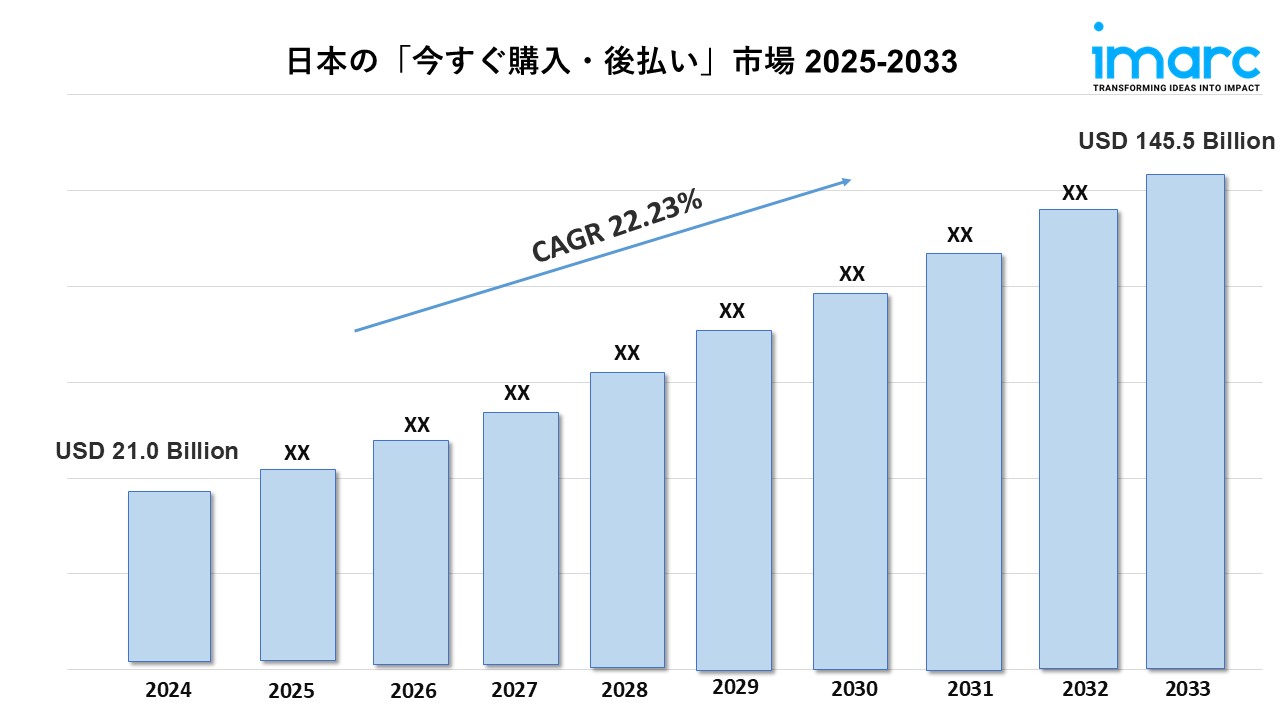

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024: USD 21.0 Billion

Market Forecast in 2033: USD 145.5 Billion

Market Growth Rate: 22.23% (2025-2033)

According to the latest report by IMARC Group, “The Japan buy now pay later market size reached USD 21.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 145.5 Billion by 2033, exhibiting a growth rate (CAGR) of 22.23% during 2025-2033.”

Get Your Free Sample PDF Now: https://www.imarcgroup.com/japan-buy-now-pay-later-market/requestsample

Japan Buy Now Pay Later Industry Trends and Drivers:

The Japanese buy now pay later market has seen its explosive growth with the fast shifting consumer payment trends and speeding up the digitalization of commerce. The millennial and the Generation Z consumers as well as the younger generation are increasingly adopting the flexibility in payment systems that enable them to better spend money without necessarily using the traditional credit cards. The COVID-19 pandemic also dramatically increased the pace of Japanese e-commerce adoption, which provided BNPL services with a fertile environment as more people begin to shop online for clothes and electronics, as well as entertainment and medical supplies. The Japanese traditional fear of credit card debt also makes BNPL especially attractive to Japanese consumers, with such services usually providing interest-free installment payments on purchases made in the short term. Large retailers and e-commerce platforms are slowly adopting BNPL solutions in checkout to curb the rate of cart abandonment and to maximize the average purchase value, as they know that flexible payment options have a direct impact on the buying decision.

The competitive environment is becoming increasingly high with domestic payment providers and foreign BNPL experts increasing their presence in the Japanese market. The innovation in financial technology is facilitating a seamless incorporation of BNPL service into the online and physical point-of-sale setting, with mobile payment applications integrating BNPL support to provide the consumer with all the flexibility. Both large and small-to-medium enterprises are implementing BNPL solutions to both find price-conscious consumers and operate in a more digital marketplace. Fashion and consumer electronics are top adopters of BNPL, and these industries have large transaction volumes since consumers are finding cheaper methods to acquire high-priced products. The market is evolving under regulatory changes in the field of consumer protection and responsible lending where providers have established strong credit check systems and fee models. Another area where BNPL is increasingly being used in the leisure and entertainment sector is when it comes to booking travel products, purchasing event tickets, or prioritizing a subscription service, with consumers looking to pay in installments to capture the costs of experiential spending.

Japan Buy Now Pay Later Market Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest Japan buy now pay later market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

Channel Insights:

- Online

- Point of Sale (POS)

Enterprise Size Insights:

- Large Enterprises

- Small and Medium Enterprises

End Use Insights:

- Consumer Electronics

- Fashion and Garment

- Healthcare

- Leisure and Entertainment

- Retail

- Others

Regional Insights:

- Kanto Region

- Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Request Customization for More Targeted Market Insights: https://www.imarcgroup.com/request?type=report&id=19903&flag=E

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant. Additionally, the report features detailed profiles of all major companies in the Japan buy now pay later industry.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact:

Street: 563-13 Kamien

Area: Iwata

Country: Tokyo Japan

Postal Code: 4380111

Email: sales@imarcgroup.com