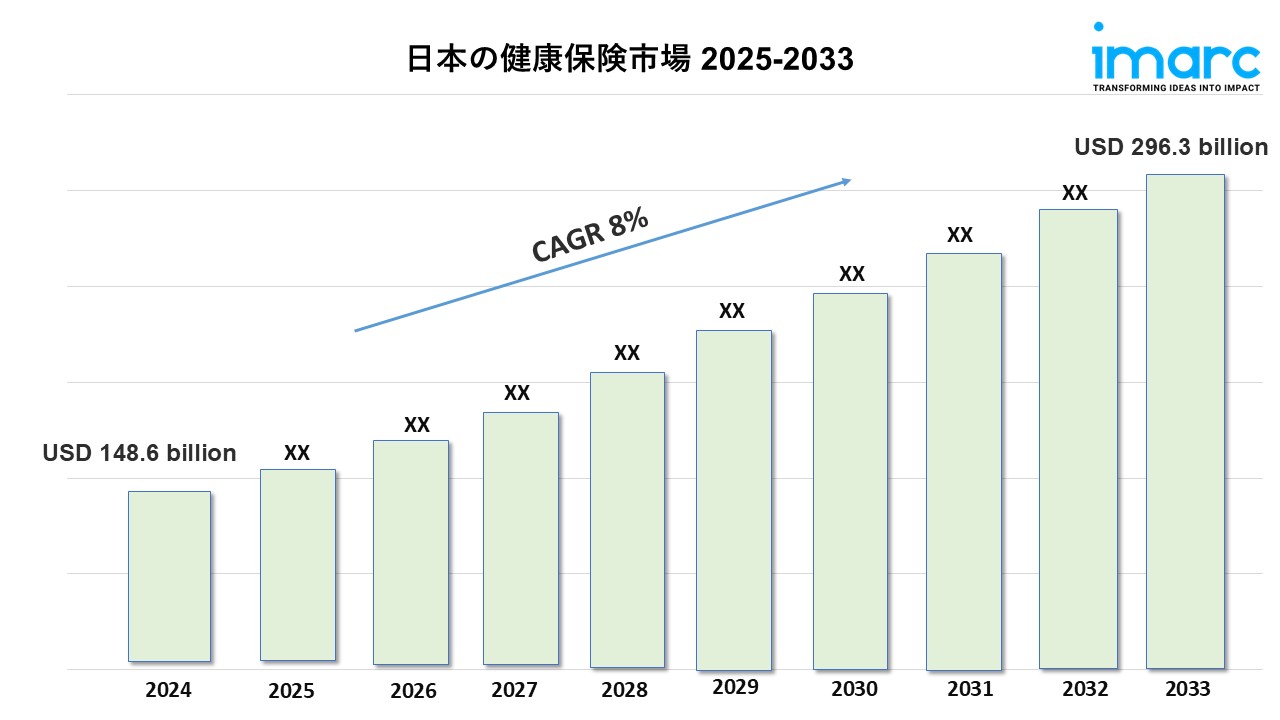

Japan Health Insurance Market Size and Growth Overview (2025-2033)

Market Size in 2024: USD 148.6 Billion

Market Forecast in 2033: USD 296.3 Billion

Market Growth Rate 2025-2033: 8%

According to the latest report by IMARC Group, “The Japan health insurance market size reached USD 148.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 296.3 Billion by 2033, exhibiting a growth rate (CAGR) of 8% during 2025-2033.”

Download a sample PDF of this report: https://www.imarcgroup.com/japan-health-insurance-market/requestsample

How AI is Reshaping the Future of the Japan Health Insurance Market

Artificial intelligence is fundamentally transforming the Japan health insurance market by revolutionizing underwriting processes, claims management, fraud detection, and customer engagement strategies that improve operational efficiency and enhance policyholder experiences. AI-powered risk assessment algorithms are analyzing comprehensive health data, lifestyle factors, genetic predispositions, and behavioral patterns to create more accurate and personalized risk profiles that enable fair premium pricing while identifying individuals who may benefit from preventive care interventions. Machine learning models are processing vast amounts of medical claims data, electronic health records, and population health statistics to identify trends, predict future healthcare utilization, and optimize insurance product design to meet evolving market needs and demographic shifts.

The integration of AI in claims processing is dramatically reducing administrative costs and processing times while improving accuracy and customer satisfaction. Natural language processing technologies are automatically extracting relevant information from medical reports, doctor’s notes, and invoices to validate claims, identify missing documentation, and flag inconsistencies that require human review. Computer vision systems are analyzing medical imaging and diagnostic test results to verify claimed conditions and assess treatment appropriateness, while predictive analytics are identifying potentially fraudulent claims by detecting unusual patterns, duplicate submissions, and inconsistencies between claimed conditions and typical treatment protocols, protecting insurers from financial losses and ultimately keeping premiums more affordable for honest policyholders.

Furthermore, AI technologies are enhancing customer service and engagement in the health insurance sector through intelligent chatbots and virtual assistants that provide instant answers to policy questions, claims status inquiries, and benefit explanations available 24/7 across multiple communication channels. Personalized recommendation engines powered by AI are suggesting optimal insurance coverage based on individual health status, family situation, and financial circumstances, while predictive models are identifying policyholders at risk for chronic conditions and proactively offering wellness programs, preventive screenings, and health coaching services that improve health outcomes and reduce long-term claims costs. AI-driven health management platforms are integrating with wearable devices and health apps to monitor policyholder health metrics, provide personalized health insights, and offer premium discounts or rewards for healthy behaviors, creating value-based insurance models that incentivize wellness and align insurer and policyholder interests.

Japan Health Insurance Market Trends & Drivers

The Japan health insurance market is experiencing robust growth driven by the rapidly aging population and increasing longevity, which are creating sustained demand for comprehensive health coverage that addresses age-related medical conditions, long-term care needs, and extended healthcare utilization throughout retirement years. The rising prevalence of chronic diseases including diabetes, cardiovascular conditions, and cancer is motivating individuals to seek supplementary health insurance that covers gaps in the national health insurance system, particularly for advanced treatments, extended hospitalizations, and out-of-pocket medical expenses. Growing awareness about the financial burden of serious illness and the limitations of public health insurance coverage is encouraging middle-class families to invest in private health insurance products that provide financial security and access to premium healthcare services.

The market is benefiting from increasing disposable incomes and the expanding middle class with greater financial capacity to purchase voluntary health insurance products beyond mandatory coverage. The diversification of insurance products including critical illness policies, cancer-specific insurance, and family floater plans is making health insurance more accessible and relevant to diverse consumer needs and life stages. Additionally, digital transformation in the insurance sector is improving customer acquisition, policy management, and claims processing through online platforms and mobile applications that enhance convenience and transparency, while corporate employee benefit programs are expanding to include more comprehensive health insurance options as companies compete for talent in tight labor markets, and government initiatives promoting private health insurance as a complement to the public system are creating a supportive regulatory environment for market growth and innovation.

Japan Health Insurance Market Industry Segmentation

The report has segmented the market into the following categories:

Breakup by Provider:

- Private Providers

- Public Providers

Breakup by Type:

- Life-Time Coverage

- Term Insurance

Breakup by Plan Type:

- Medical Insurance

- Critical Illness Insurance

- Family Floater Health Insurance

- Others

Breakup by Demographics:

- Minor

- Adults

- Senior Citizen

Breakup by Provider Type:

- Preferred Provider Organizations (PPOs)

- Point of Service (POS)

- Health Maintenance Organizations (HMOs)

- Exclusive Provider Organizations (EPOs)

Breakup by Region:

- Kanto Region

- Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Request a Customized Version of This Report for Deeper Insights: https://www.imarcgroup.com/request?type=report&id=9332&flag=E

Competitive Landscape

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Recent News and Developments in Japan Health Insurance Market

- In 2023, Nippon Life Insurance Company announced a strategic partnership with H2O.ai to enhance its insurance business through advanced machine learning technologies. This collaboration aims to integrate H2O.ai’s AI-driven solutions to improve customer health management and streamline insurance processes. The implementation of these machine learning models is expected to transform how Nippon Life analyzes health data, predicts customer needs, and personalizes insurance offerings.

- In 2024, Dai-ichi Life Insurance Company made a significant move by announcing its investment in the Nippon Life Insurance Company’s insurance technology venture, known as Digital Life Holdings. This investment, amounting to approximately ¥10 billion (about $76 million), aims to enhance Dai-ichi Life’s capabilities in digital insurance services. The collaboration focuses on leveraging advanced technologies to improve customer experiences, streamline operations, and drive innovation in the health insurance sector.

Future Outlook

The Japan health insurance market is positioned for substantial growth as demographic pressures intensify and the gap between public health insurance coverage and actual healthcare costs continues to widen. Technological innovation, particularly in AI, telemedicine, and personalized medicine, will create new insurance product opportunities and enable more sophisticated risk management. As consumers become more health-conscious and proactive about managing their wellbeing, demand for value-added services including wellness programs, preventive care, and digital health management will drive product differentiation and customer loyalty, while regulatory evolution supporting private health insurance expansion will create a favorable environment for market growth and establish health insurance as an essential component of comprehensive financial planning for Japanese households.

Key Highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

563-13 Kamien, Iwata City Country, SHIZUOKA, JP, 4380111

+1-631-791-1145